Vt Real Estate Taxes . Contact your town to find out the tax. overview of vermont taxes. the average property tax rate is 1.90%, which works out to $7,609 each year for the median home value in the state. In vermont, transfer tax is usually covered by the buyer, meaning you shouldn't need to pay this expense. In response, the house tax committee is considering its options, including changing a. of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal. a new estimate puts the projected average property tax bill increase next year at more than 20%. Visit the vermont department of taxes website to file your homestead declaration and property tax. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. your vermont property tax bill. Find guidance on who can file, how to file, and faqs.

from www.pdffiller.com

Find guidance on who can file, how to file, and faqs. your vermont property tax bill. Contact your town to find out the tax. of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. In vermont, transfer tax is usually covered by the buyer, meaning you shouldn't need to pay this expense. Visit the vermont department of taxes website to file your homestead declaration and property tax. overview of vermont taxes. a new estimate puts the projected average property tax bill increase next year at more than 20%. In response, the house tax committee is considering its options, including changing a.

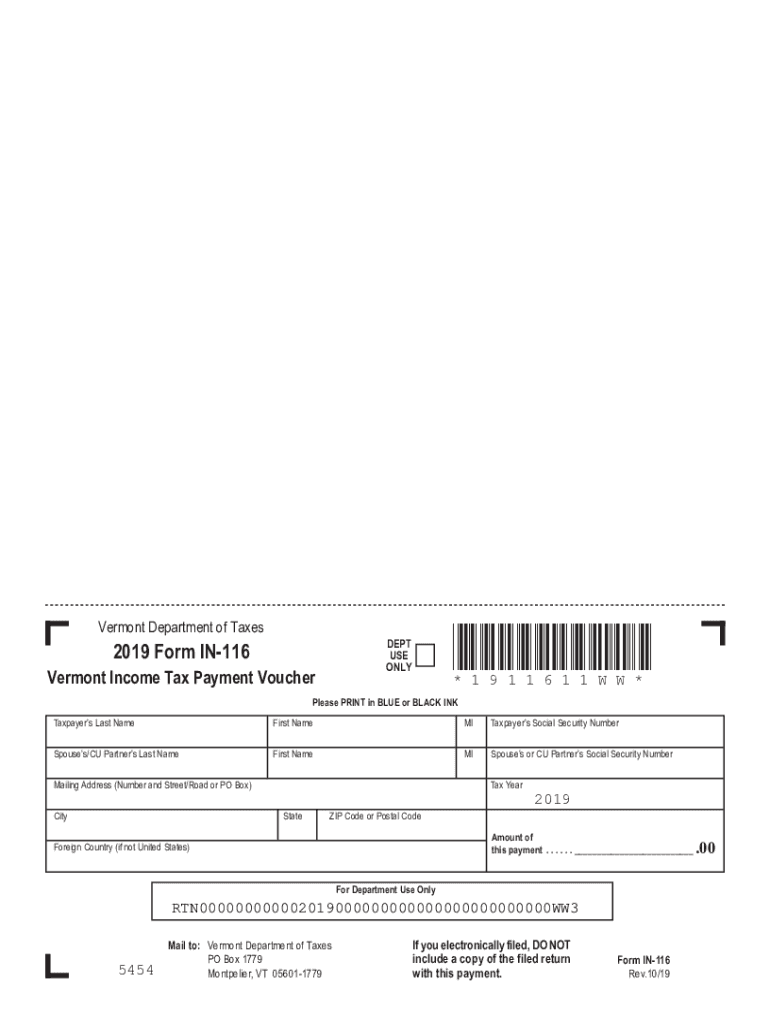

Fillable Online Vermont Taxes and VT State Tax Forms eFile Fax

Vt Real Estate Taxes Find guidance on who can file, how to file, and faqs. In response, the house tax committee is considering its options, including changing a. Find guidance on who can file, how to file, and faqs. your vermont property tax bill. Visit the vermont department of taxes website to file your homestead declaration and property tax. of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal. a new estimate puts the projected average property tax bill increase next year at more than 20%. In vermont, transfer tax is usually covered by the buyer, meaning you shouldn't need to pay this expense. overview of vermont taxes. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. Contact your town to find out the tax. the average property tax rate is 1.90%, which works out to $7,609 each year for the median home value in the state.

From study.com

Quiz & Worksheet VT Real Estate Taxes Vt Real Estate Taxes In response, the house tax committee is considering its options, including changing a. the average property tax rate is 1.90%, which works out to $7,609 each year for the median home value in the state. your vermont property tax bill. a new estimate puts the projected average property tax bill increase next year at more than 20%.. Vt Real Estate Taxes.

From www.propertyrebate.net

Vt Property Tax Rebate Calculator Vt Real Estate Taxes of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. In response, the house tax committee is considering its options, including changing a. In vermont, transfer tax is usually covered by. Vt Real Estate Taxes.

From listwithclever.com

Vermont Real Estate Transfer Taxes An InDepth Guide Vt Real Estate Taxes Tax bills are generally mailed to property owners 30 days prior to the property tax due date. In vermont, transfer tax is usually covered by the buyer, meaning you shouldn't need to pay this expense. overview of vermont taxes. Contact your town to find out the tax. Find guidance on who can file, how to file, and faqs. In. Vt Real Estate Taxes.

From www.dochub.com

Vermont 2023 tax form Fill out & sign online DocHub Vt Real Estate Taxes In vermont, transfer tax is usually covered by the buyer, meaning you shouldn't need to pay this expense. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. In response, the house tax committee is considering its options, including changing a. the average property tax rate is 1.90%, which works out to. Vt Real Estate Taxes.

From taxfoundation.org

State & Local Property Tax Collections per Capita Tax Foundation Vt Real Estate Taxes In vermont, transfer tax is usually covered by the buyer, meaning you shouldn't need to pay this expense. overview of vermont taxes. a new estimate puts the projected average property tax bill increase next year at more than 20%. the average property tax rate is 1.90%, which works out to $7,609 each year for the median home. Vt Real Estate Taxes.

From www.formsbank.com

Vermont Estate Tax Return Form Instructions printable pdf download Vt Real Estate Taxes Contact your town to find out the tax. In vermont, transfer tax is usually covered by the buyer, meaning you shouldn't need to pay this expense. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. a new estimate puts the projected average property tax bill increase next year at more than. Vt Real Estate Taxes.

From www.peetlaw.com

Vermont Property Transfer Tax Vt Real Estate Taxes Visit the vermont department of taxes website to file your homestead declaration and property tax. Contact your town to find out the tax. In vermont, transfer tax is usually covered by the buyer, meaning you shouldn't need to pay this expense. of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead. Vt Real Estate Taxes.

From www.xoatax.com

Vermont Property Tax Rates Highlights 2024 Vt Real Estate Taxes Find guidance on who can file, how to file, and faqs. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. Visit the vermont department of taxes website to file your homestead declaration and property tax. a new estimate puts the projected average property tax bill increase next year at more than. Vt Real Estate Taxes.

From wallethub.com

Property Taxes by State Vt Real Estate Taxes your vermont property tax bill. overview of vermont taxes. the average property tax rate is 1.90%, which works out to $7,609 each year for the median home value in the state. Contact your town to find out the tax. Find guidance on who can file, how to file, and faqs. Tax bills are generally mailed to property. Vt Real Estate Taxes.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Vt Real Estate Taxes Tax bills are generally mailed to property owners 30 days prior to the property tax due date. your vermont property tax bill. In vermont, transfer tax is usually covered by the buyer, meaning you shouldn't need to pay this expense. Find guidance on who can file, how to file, and faqs. a new estimate puts the projected average. Vt Real Estate Taxes.

From chucksplaceonb.com

Real Estate Taxes vs Property Taxes What Are the Differences? Chuck Vt Real Estate Taxes Tax bills are generally mailed to property owners 30 days prior to the property tax due date. Contact your town to find out the tax. In response, the house tax committee is considering its options, including changing a. of the 257 towns and villages with tax data available, 87% of towns saw increases to their homestead tax in fiscal.. Vt Real Estate Taxes.

From www.hegwoodgroup.com

5 Common Real Estate Tax Mistakes Property Tax Consultant Tips Vt Real Estate Taxes Find guidance on who can file, how to file, and faqs. the average property tax rate is 1.90%, which works out to $7,609 each year for the median home value in the state. your vermont property tax bill. Visit the vermont department of taxes website to file your homestead declaration and property tax. In vermont, transfer tax is. Vt Real Estate Taxes.

From taxfoundation.org

Best & Worst Property Tax Codes in the U.S. Tax Foundation Vt Real Estate Taxes your vermont property tax bill. overview of vermont taxes. In vermont, transfer tax is usually covered by the buyer, meaning you shouldn't need to pay this expense. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. of the 257 towns and villages with tax data available, 87% of towns. Vt Real Estate Taxes.

From www.quickenloans.com

Real Estate Taxes Vs. Property Taxes Quicken Loans Vt Real Estate Taxes Find guidance on who can file, how to file, and faqs. the average property tax rate is 1.90%, which works out to $7,609 each year for the median home value in the state. overview of vermont taxes. In vermont, transfer tax is usually covered by the buyer, meaning you shouldn't need to pay this expense. a new. Vt Real Estate Taxes.

From nancyjenkins.com

Vermont Property Tax Rates Nancy Jenkins Real Estate Vt Real Estate Taxes Contact your town to find out the tax. your vermont property tax bill. Tax bills are generally mailed to property owners 30 days prior to the property tax due date. In response, the house tax committee is considering its options, including changing a. overview of vermont taxes. of the 257 towns and villages with tax data available,. Vt Real Estate Taxes.

From www.formsbank.com

Form Rew1 Vermont Withholding Tax Return For Transfer Of Real Vt Real Estate Taxes overview of vermont taxes. Visit the vermont department of taxes website to file your homestead declaration and property tax. your vermont property tax bill. the average property tax rate is 1.90%, which works out to $7,609 each year for the median home value in the state. In vermont, transfer tax is usually covered by the buyer, meaning. Vt Real Estate Taxes.

From www.templateroller.com

VT Form RW171 Fill Out, Sign Online and Download Fillable PDF Vt Real Estate Taxes Tax bills are generally mailed to property owners 30 days prior to the property tax due date. In response, the house tax committee is considering its options, including changing a. the average property tax rate is 1.90%, which works out to $7,609 each year for the median home value in the state. of the 257 towns and villages. Vt Real Estate Taxes.

From www.pinterest.com

Chart 4 Vermont Local Tax Burden by County FY 2015.JPG Vermont Vt Real Estate Taxes a new estimate puts the projected average property tax bill increase next year at more than 20%. Contact your town to find out the tax. Find guidance on who can file, how to file, and faqs. the average property tax rate is 1.90%, which works out to $7,609 each year for the median home value in the state.. Vt Real Estate Taxes.